child tax credit monthly payments continue in 2022

The Plan runs from 2018 to 2022. Universal Credit has replaced Working Tax Credit WTC and Child Tax Credit CTC.

Racial Justice Organizations Ask Congress To Reinstate Child Tax Credit

On 15 February 2021 we introduced the Scottish Child Payment for.

. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Will the child credit continue in 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Families who are eligible for the expanded credit may see more money come to them when they file their taxes this year as just half of the total child tax. Thats because only half the money came via the monthly installments. Simple or complex always free.

The 2021 advance was 50 of your child tax credit with the rest on the next years return. Ad File a federal return to claim your child tax credit. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on.

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

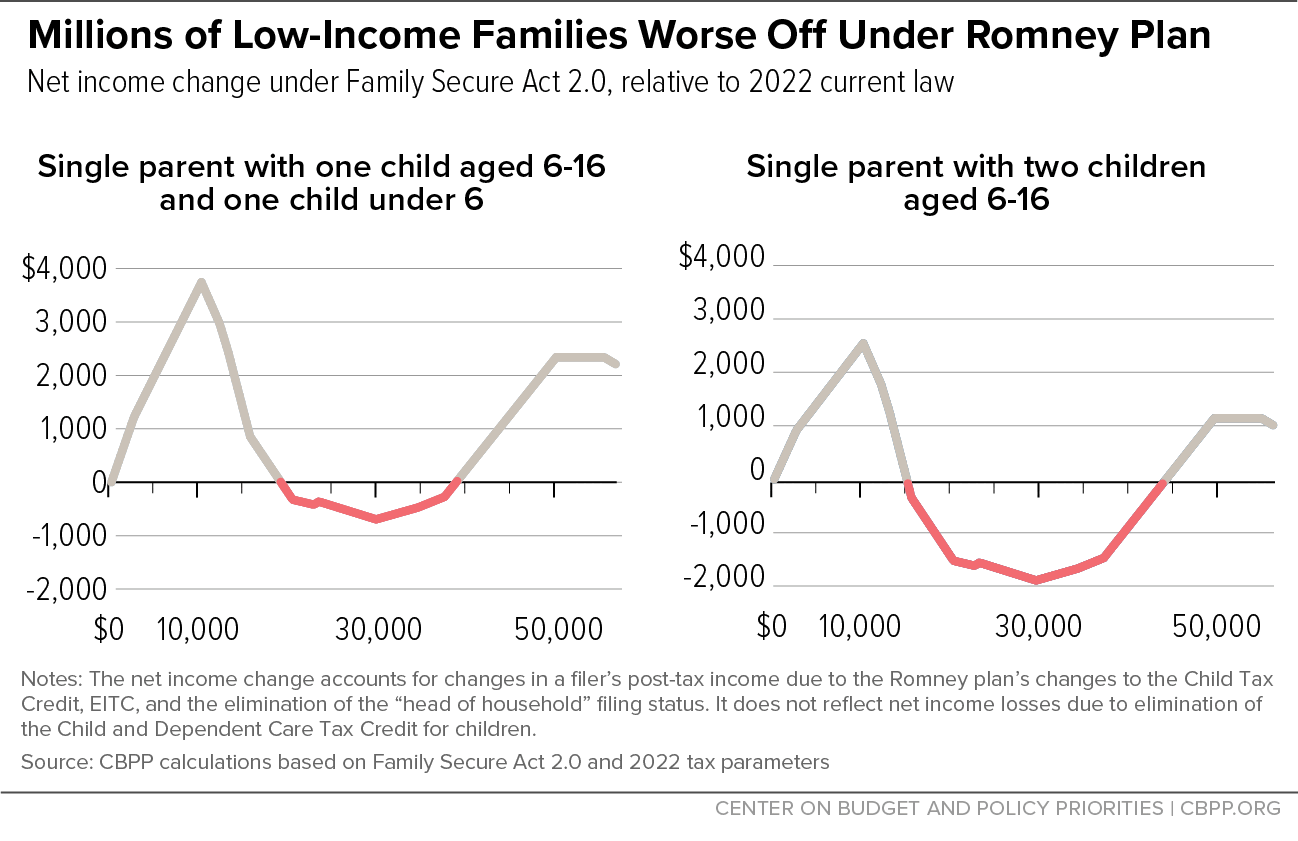

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

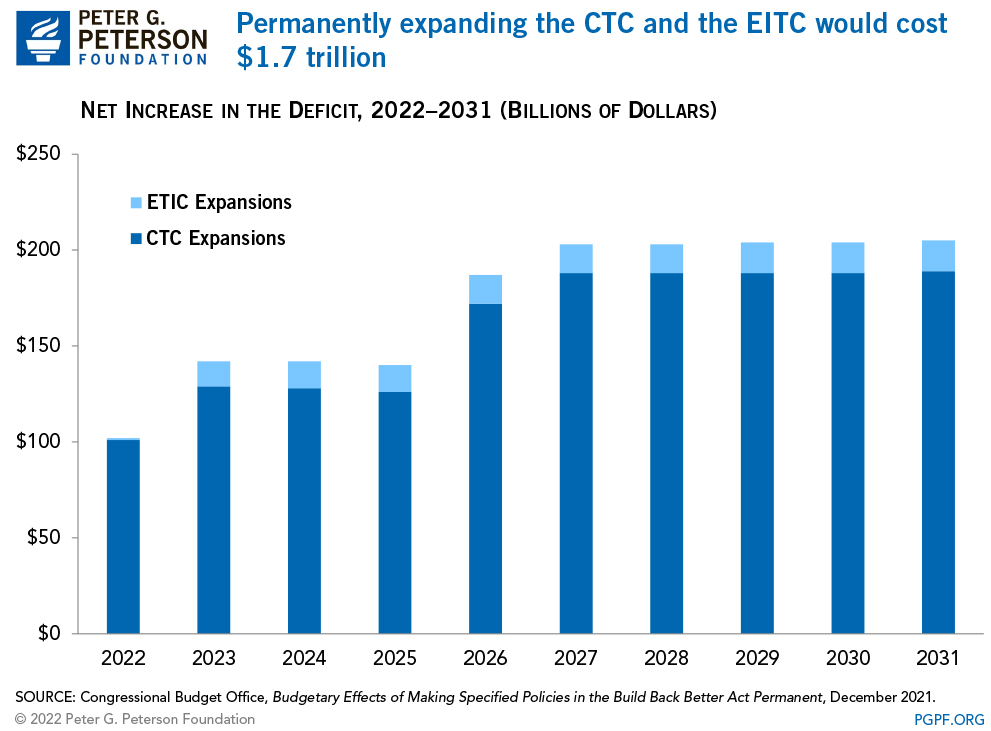

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Stimulus Update There May Still Be Hope For Monthly Child Tax Credit Payments In 2022 Here S Why

Will Child Tax Credit Payments Be Extended In 2022 Money

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

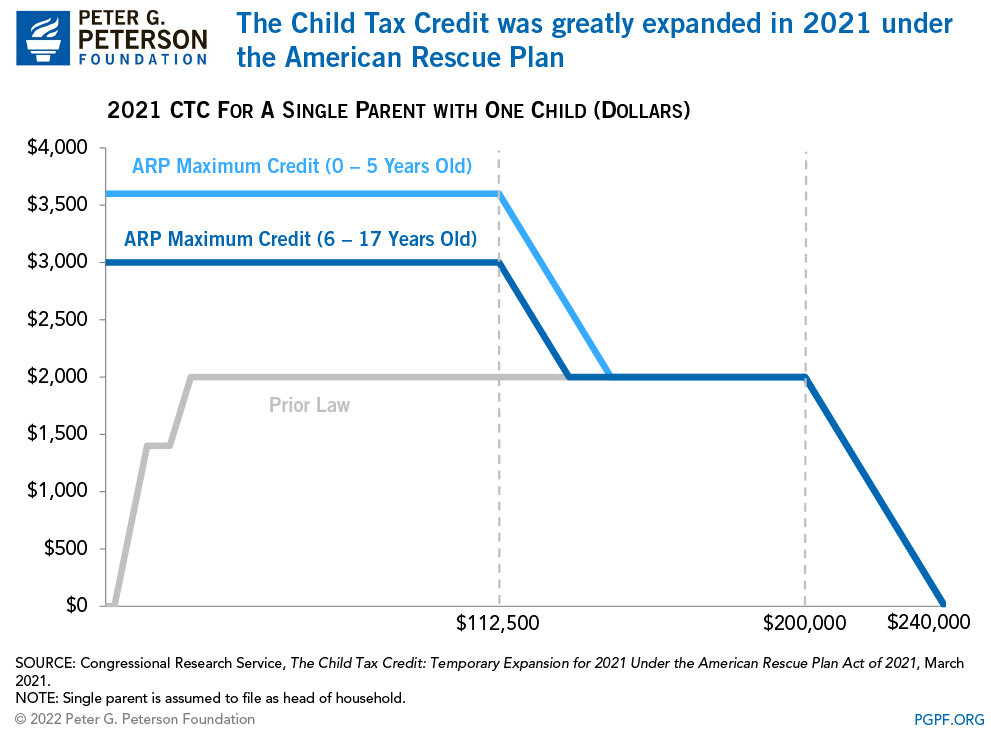

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Child Tax Credit Payments May Boost Retail Sales As Soon As This Month

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

The Child Tax Credit Could Have Helped Fight Inflation The New Republic